The insurance industry faces many challenges. Customer needs and expectations are evolving, just like in any other industry. Keeping up with these shifts — along with changing regulatory requirements, rising costs, reliance on legacy platforms, and competition from digitally focused insurtechs — is pushing many large insurers to launch digital transformation programs.

Typical objectives include reducing costs, modernizing platforms, improving customer experience, expanding distribution channels, delivering new digital products, and gaining better insights through analytics.

Salesforce Digital Insurance Platform

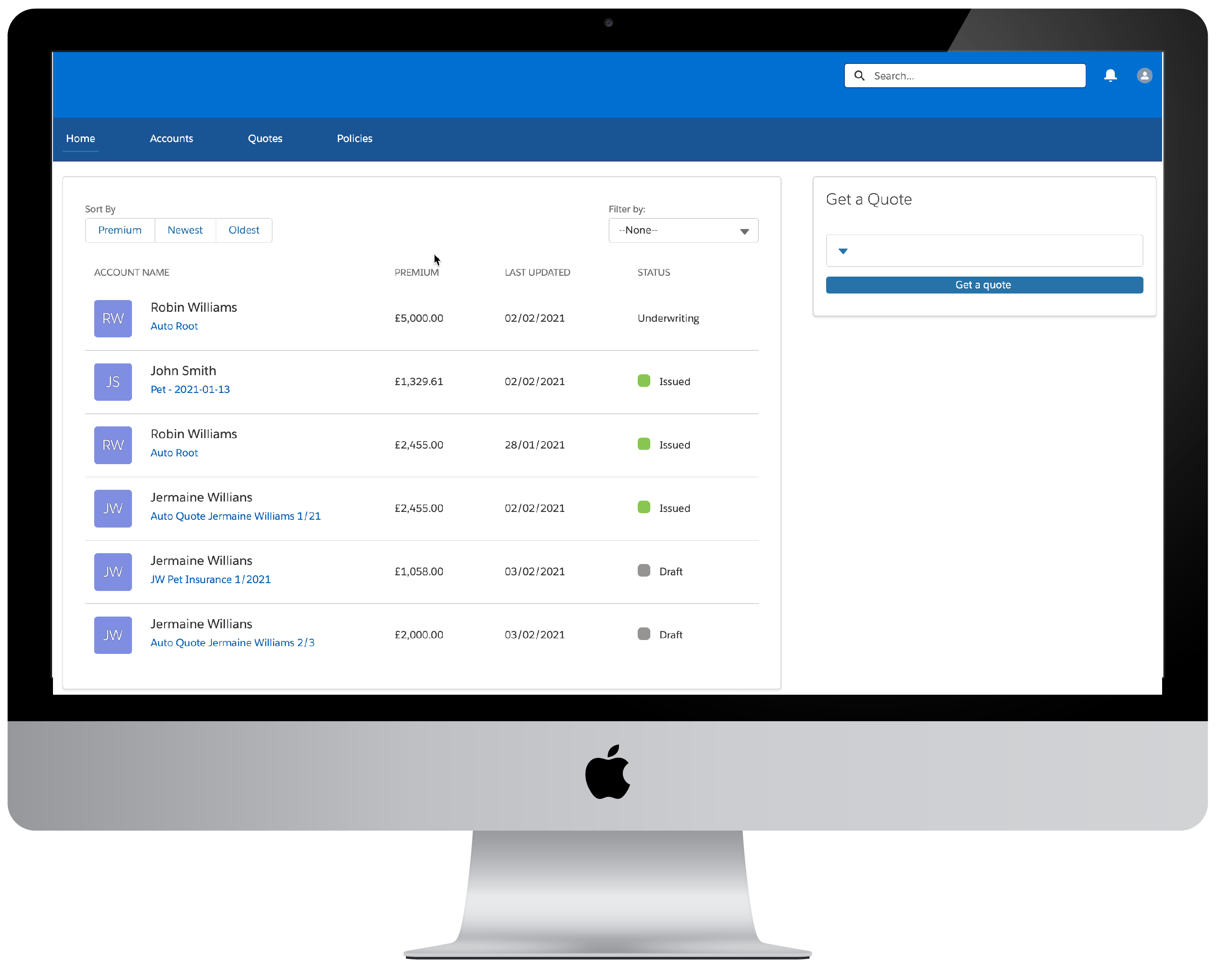

Broker Portal Solutions

Speed up Salesforce Broker Portal implementation with our accelerator

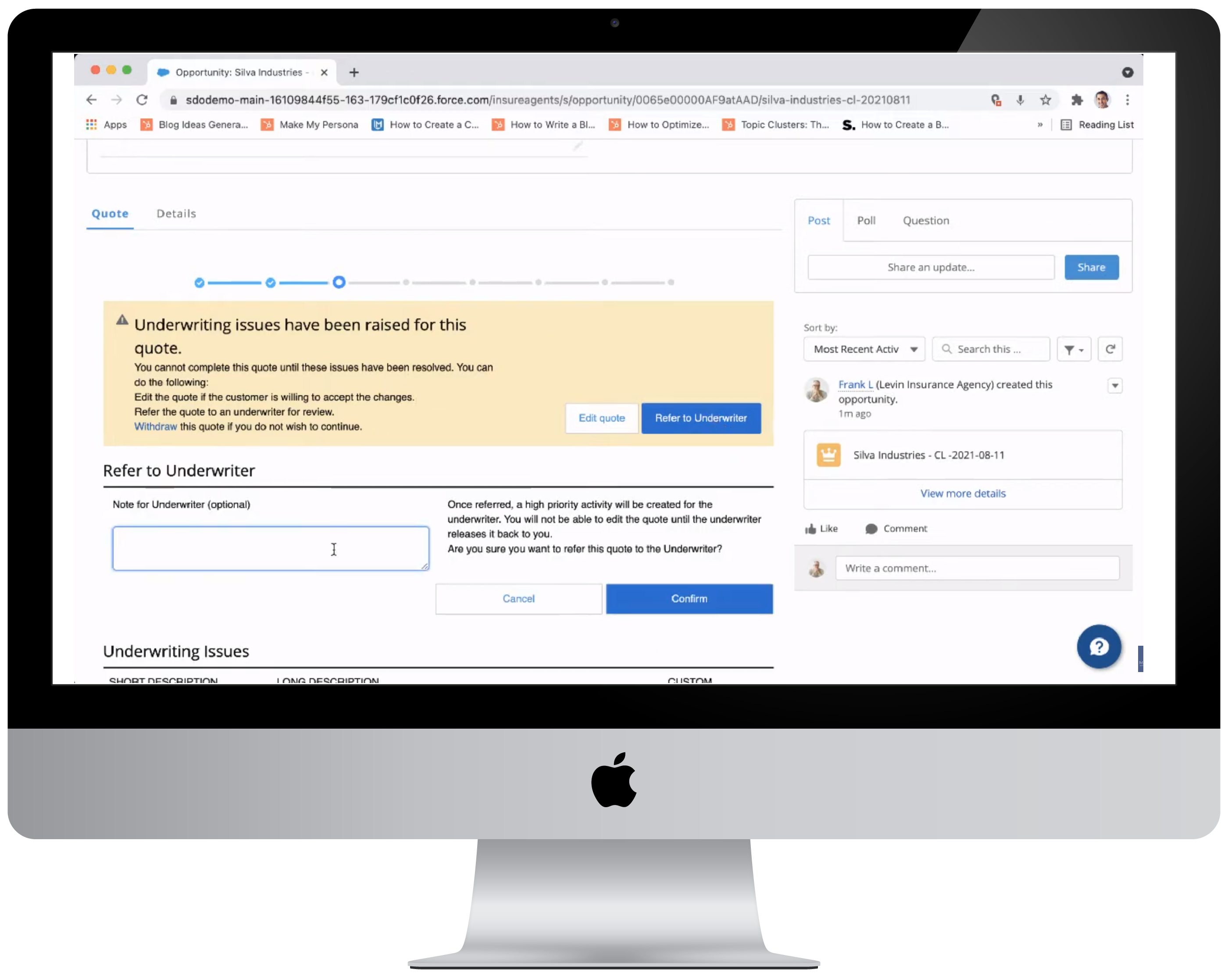

Underwriting Quickstart

Cloobees can accelerate the delivery of the full Underwriting Workbench module from Salesforce

Insights from our experts

Insurance

How can Insurers leverage Salesforce AI today?

If you search ‘How AI can help the Insurance Market’ on Google today, the results are plentiful, 248M to be precise! So, with all the buzz around AI now, it is easy for some of us to forget that Salesforce has had AI capabilities for more than six years in the form of Einstein AI.

Team Experience

Insurance

Salesforce Broker Portal implementation for Tier 1 Health Insurer in the UK

Digital Transformation Programme for one of the leading Health Insurance providers in the UK for both B2B and B2C scenarios with built-in Broker Portal:

Insurance

Salesorce based transformation for Large Health Insurer in the UK

Salesforce Insurance Platform implementation of a quote to bind journey for one of the leading Health Insurance providers in the UK:

Insurance

Digital transformation programme for Tier 1 B2C insurance carrrier

Salesforce Insurance Platform implementation for one of the leading Insurance providers:

UK

Cloobees UK – A Synechron CompanyUnited States

Cloobees - US officeEurope

India

Cloobees India Private Ltd – New DelhiOur delivery centers: